Seniors Leveraging Reverse Mortgages as an Investment Strategy

Seniors Leveraging Reverse Mortgages as an Investment Strategy

Reverse mortgages are often misunderstood. Most people picture seniors using them to withdraw equity for living expenses, vacations, or to cover unexpected bills. But what if a reverse mortgage wasn’t about taking money out at all? What if it could be positioned as an investment tool, designed to strengthen retirement security, hedge against risks, and even enhance estate planning?

That’s exactly what many forward-thinking retirees are now exploring. By reframing the reverse mortgage as an asset rather than a last resort, seniors can create flexibility, liquidity, and growth potential without touching their portfolios prematurely.

1. The Investment Angle: Not Spending, But Growing

The key difference lies in how the reverse mortgage is used. Instead of immediately drawing funds, seniors can establish a Home Equity Conversion Mortgage (HECM) line of credit and let it grow.

-

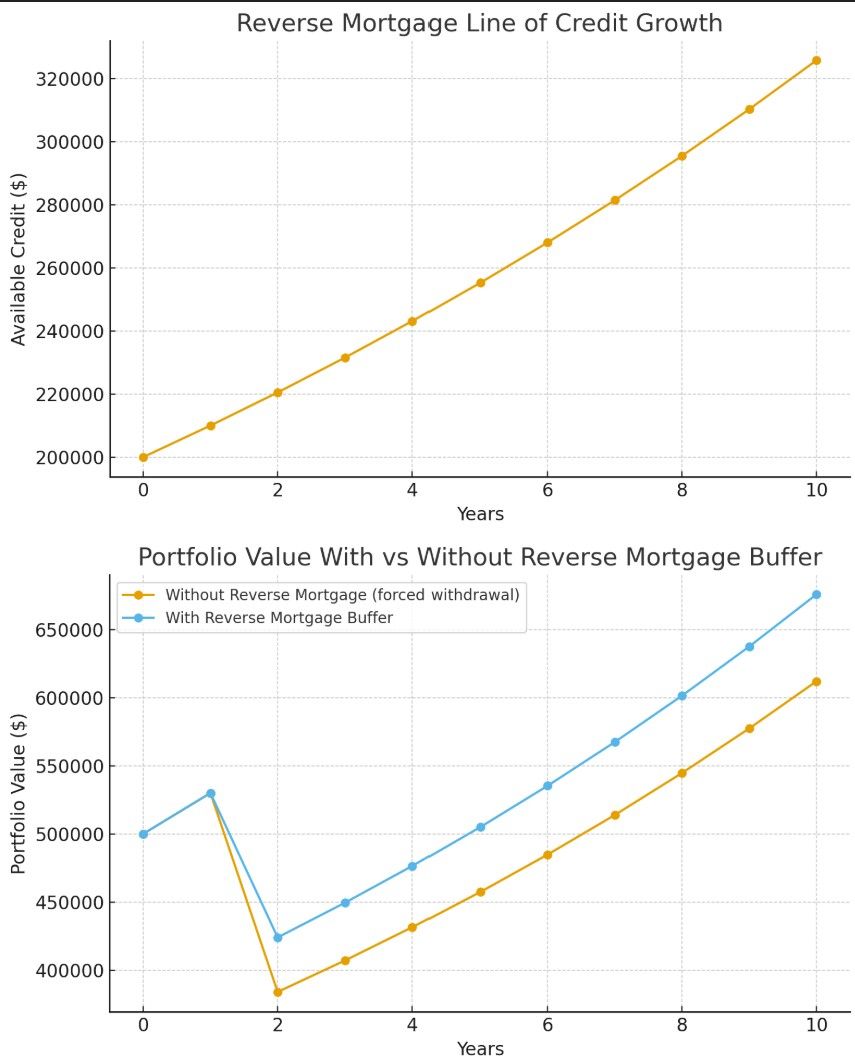

Unlike a traditional home equity line of credit (HELOC), the available balance on a reverse mortgage line of credit grows over time, typically at the same rate as the loan’s interest rate.

-

This means that the longer it remains unused, the more powerful the credit line becomes.

💡 Think of it as planting a financial seed in your home equity that grows quietly in the background, waiting to be used only if and when needed.

Example:

A 65-year-old homeowner with a $500,000 home establishes a reverse mortgage line of credit of $200,000. If unused, that line of credit may grow by about 5% annually (depending on rates). By age 75, it could exceed $325,000—without the homeowner ever withdrawing a dime.

2. Protecting Investments During Market Volatility

One of the most powerful applications of this strategy is using reverse mortgages as a buffer against market downturns.

-

Retirees often rely on their investment portfolios (401(k), IRAs, brokerage accounts) for income.

-

If the market falls, selling investments at a loss locks in those losses and stunts long-term portfolio growth.

-

A reverse mortgage line of credit provides temporary liquidity, allowing seniors to cover expenses without touching investments until markets recover.

Scenario:

Imagine a retiree needs $40,000 for living expenses during a market dip.

-

Option A (without reverse mortgage): Sell stocks at depressed prices, locking in a 20% loss.

-

Option B (with reverse mortgage credit line): Draw $40,000 tax-free from the reverse mortgage, then repay or leave it outstanding while waiting for the market to rebound.

📊 Chart Idea: A line graph showing portfolio recovery when assets are preserved vs. when withdrawals are made during a downturn. The “with reverse mortgage” line shows stronger long-term growth.

3. Tax-Efficient Retirement Planning

Because reverse mortgage proceeds are loan advances—not income—they are generally not taxable. This creates opportunities to manage tax brackets and optimize retirement distributions:

-

Delay Social Security to maximize lifetime benefits.

-

Minimize required withdrawals from IRAs/401(k)s that could push retirees into higher tax brackets.

-

Supplement cash flow in years with higher medical or long-term care costs, without triggering taxable gains.

Example:

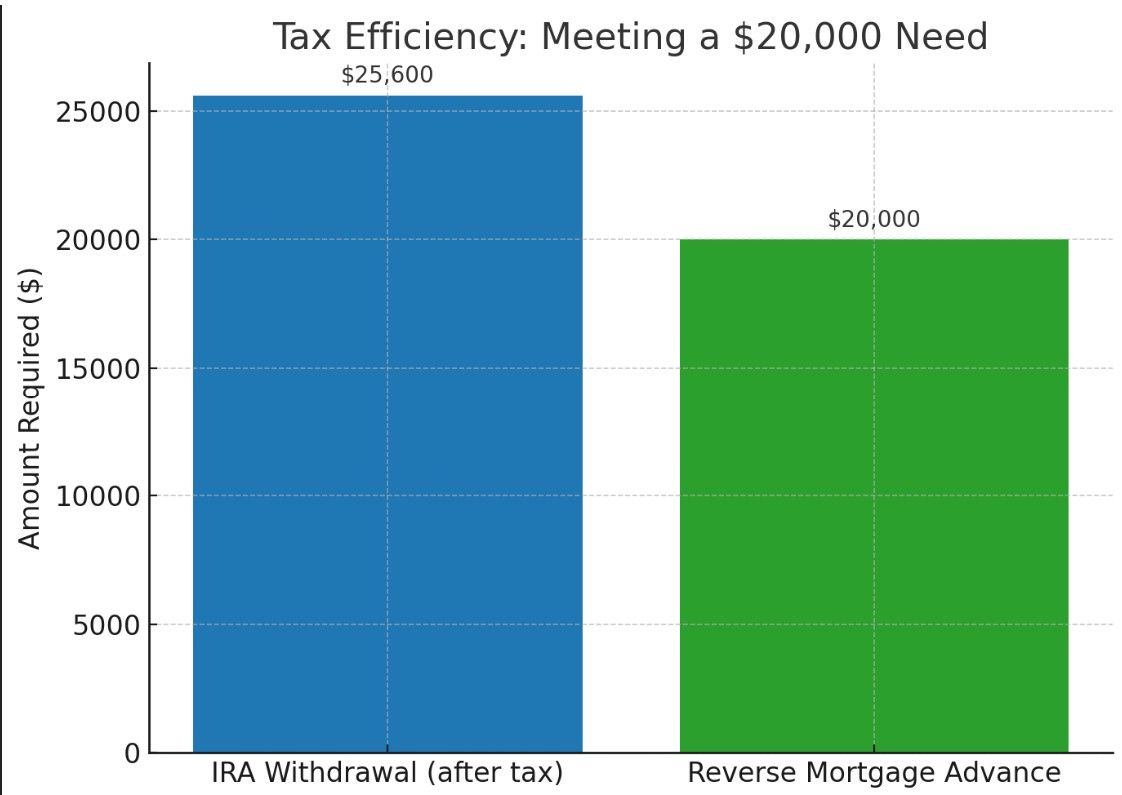

A retiree in the 22% tax bracket needs $20,000.

-

If withdrawn from a traditional IRA, they must take about $25,600 before taxes.

-

From a reverse mortgage credit line, they simply withdraw $20,000 tax-free.

Over a 10-year period, this tax-efficient strategy could mean tens of thousands saved in unnecessary taxes.

4. Estate Planning Benefits

Some seniors worry that using a reverse mortgage means losing the family home. But when positioned strategically, it can actually enhance estate planning:

-

By preserving investment portfolios during downturns, heirs may receive larger financial inheritances.

-

The reverse mortgage is non-recourse—heirs will never owe more than the home’s value, regardless of market conditions.

-

If the credit line grows unused, it becomes a significant source of emergency liquidity late in life, helping to avoid forced asset sales.

5. A Strategic Reserve, Not a Last Resort

The biggest mindset shift is this: a reverse mortgage doesn’t have to be a “last-resort lifeline.” When used intentionally, it becomes a strategic reserve—a pool of capital that grows in the background, ready to be tapped when it strengthens the overall financial plan.

Conclusion

For seniors who want to safeguard their retirement, reduce risk, and create tax-efficient flexibility, using a reverse mortgage as an investment tool makes sense. It’s not about spending today’s equity—it’s about building tomorrow’s security.

By establishing a line of credit early, letting it grow, and deploying it strategically during market downturns or high-tax years, retirees can enhance both peace of mind and long-term wealth preservation.

Categories

Recent Posts