December 2025 Real Estate Market Report

Click here to see: #UtDreamHomes November 2025 Real Estate Market Report for St. George Real Estate by Dave Diegelman www.UtDreamHomes.com Feel Free to Follow Me on Social Media! December 2025 Southern Utah Real Estate Market Report, Edition # 72 As We Say Farewell to 2025... Last month, we e

Zen And The Art Of $1,000 Tomatoes

Zen And The Art Of $1,000 Tomatoes Our Southern Utah yard has spectacular views—red rock cliffs backed by snow-capped peaks. What it doesn’t have is space for a proper garden. Combine that with triple-digit summer temperatures, and gardening becomes a contact sport. For years I tried to maintain a s

The Ups and Downs of Solar

With federal tax credits set to expire at the end of December 2025, going solar may be more attainable now than ever. 🌞 The Ups of Going Solar Lower Energy Bills — Especially in Summer One of the biggest advantages to solar panels is a dramatic reduction in your electricity bills. In sunny Southern

The Truth About Selling Existing Luxury Homes In St. George Utah

The Truth About Selling Existing Luxury Homes in St. George, Utah In today’s real estate climate, it’s easy to hear the chatter: “It’s a tough market.” “Luxury isn’t moving.” “Buyers have vanished.” But when you step away from the noise and look at the actual data, a very different story emerges—esp

Marketing 101 For Real Estate

The National Association of Realtor's has done exhausting research on the patterns followed by today's home buyers. A summary of their conclusion: "98% of all home searches start online and Realtor's have no more than 10-15 seconds to captivate a buyer's interest, causing them to click on to the nex

October 2025 Real Estate Market Report for Southern Utah

Click here to see: #UtDreamHomes October 2025 Real Estate Market Report for St. George Real Estate by Dave Diegelman www.UtDreamHomes.com Feel Free to Follow Me on Social Media! October 2025 Southern Utah Real Estate Market Report, Edition # 70 Feel The Fall! We all love it when the temperatu

Neighborhoods with the Widest Price Range in Greater St. George

Neighborhoods with the Widest Price Range in Greater St. George Southern Utah’s real estate market has always been diverse, but some neighborhoods stand out because the range from entry-level to luxury is especially broad. If you’re looking for choice—not just in style but in cost—these four areas o

Bloomington Hills Market Stats Report: Steady, Diverse, and Full of Opportunity

🏡 Bloomington Hills Market Stats Report: Steady, Diverse, and Full of Opportunity By Dave Diegelman, Southern Utah Real Estate Bloomington Hills continues to be one of St. George’s most balanced and opportunity-rich neighborhoods — offering both stability and diversity across all price points. Wh

Why Let the Builder Take the Construction Loan?

Why Let the Builder Take the Construction Loan — and How a Take-Out Loan Can Work to Your Advantage Building your dream home is exciting — and complicated. One strategy that many buyers use to simplify financing and limit their risk is to have the builder take out the construction loan, then close

September 2025 Southern Utah Real Estate Market Report, Edition # 69

Click here to see: #UtDreamHomes August 2025 Real Estate Market Report for St. George Real Estate by Dave Diegelman www.UtDreamHomes.com Feel Free to Follow Me on Social Media! September 2025 Southern Utah Real Estate Market Report, Edition # 69 Summer is over! —At least on the calendar—but S

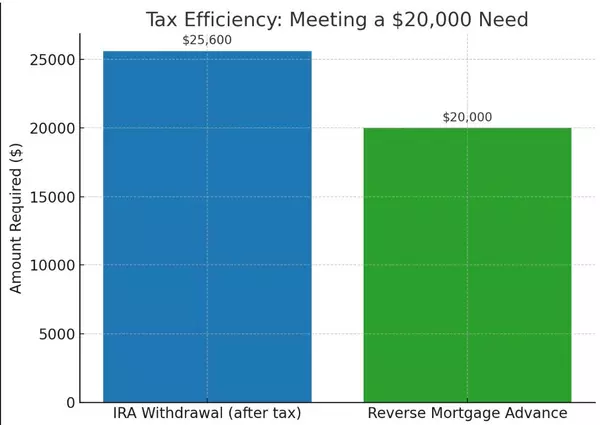

Seniors Leveraging Reverse Mortgages as an Investment Strategy

Seniors Leveraging Reverse Mortgages as an Investment Strategy Reverse mortgages are often misunderstood. Most people picture seniors using them to withdraw equity for living expenses, vacations, or to cover unexpected bills. But what if a reverse mortgage wasn’t about taking money out at all? What

August 2025 Southern Utah Real Estate Market Report, Edition # 68

Click here to see: #UtDreamHomes August 2025 Real Estate Market Report for St. George Real Estate by Dave Diegelman www.UtDreamHomes.com Feel Free to Follow Me on Social Media! August 2025 Southern Utah Real Estate Market Report, Edition # 68 This month we really tear apart what the numbers a

Homes Are Cheaper This Year for These Buyers

Homes Are Cheaper This Year for These Buyers 📉 How a Weak U.S. Dollar Is Shaping the Real Estate Landscape International homebuyers are currently enjoying a rare advantage: a weaker U.S. dollar. According to Redfin, currency gains from nations such as Russia, Japan, Switzerland, Sweden, Europe, a

The Unique Challenges of Selling a Home for Seniors—and How I Help

The Unique Challenges of Selling a Home for Seniors—and How I Help Selling a home is rarely simple, but for seniors, it often comes with unique challenges that require a thoughtful, experienced approach. Over the years, I’ve had the privilege of helping many older clients navigate these transitions,

First-Time Homebuyer Programs in Southern Utah: What You Need to Know

🏡 First-Time Homebuyer Programs in Southern Utah: What You Need to Know Buying your first home is a big step—and if you're navigating the market in Southern Utah, you don't have to go it alone. There are several excellent programs designed to help first-time buyers with down payments, closing costs

Greater St. George Market Watch: $750K–$1M Homes with Space to Spare, July 2025

📊 Greater St. George Market Watch: $750K–$1M Homes with Space to Spare If you’re in the market for a single-family home in the Greater St. George area priced between $750,000 and $1 million, with at least 4 bedrooms, 3 bathrooms, and a quarter-acre lot or more, you’re looking in one of the most com

June 2025 Southern Utah Real Estate Market Report, Edition # 66

This month's real estate market report for Southern Utah has some spectacular insights and articles including; Is the Souther Utah Real Estate Market In Trouble?, specific advise for both buyers and sellers in this market, US - China Tariffs and their potential impact on the real estate market, sp

Is The Southern Utah Market In Trouble?

Is Southern Utah Headed for a Correction? Not So Fast. With record inventory buildup, longer days on market, and an unusually high absorption rate, it might seem like Southern Utah’s housing market is headed for a correction. But a closer look at the numbers tells a different story—one of relative s

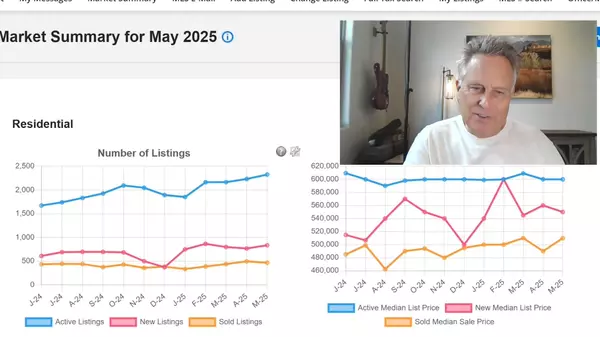

May 2025 Southern Utah Real Estate Market Report, Edition # 65

#UtDreamHomes May 2025 Real Estate Market Report for St. George Real Estate by Dave Diegelman www.UtDreamHomes.com Feel Free to Follow Me on Social Media! May 2025 Southern Utah Real Estate Market Report, Edition # 65 In this month's real estate market report highlight's several factors that are

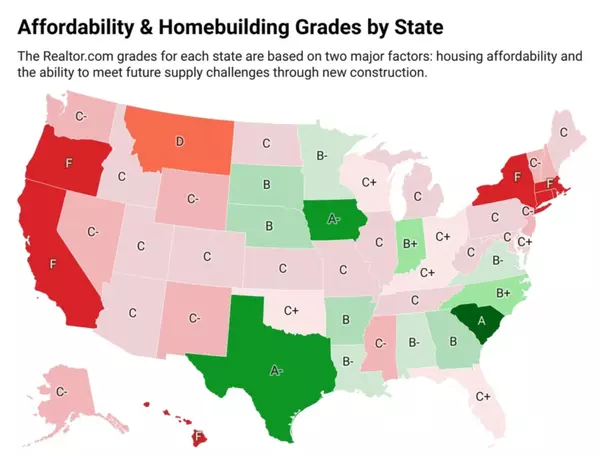

The States That Are Building To Keep Homes Affordable

The States That Are Building To Keep Homes Affordable St. George Utah used to be an affordable place to retire or own a second home. Now, it is a sought after place based on our beautiful weather, majestic red rock sculptures and year-round access to outdoor recreation at our fingertips. Not everybo

Dave Diegelman

Phone:+1(435) 703-4041